The industry needs to do more to bridge the chasm to reach EV’s ‘Early Majority’

October 19, 2023 by Sepi Arani

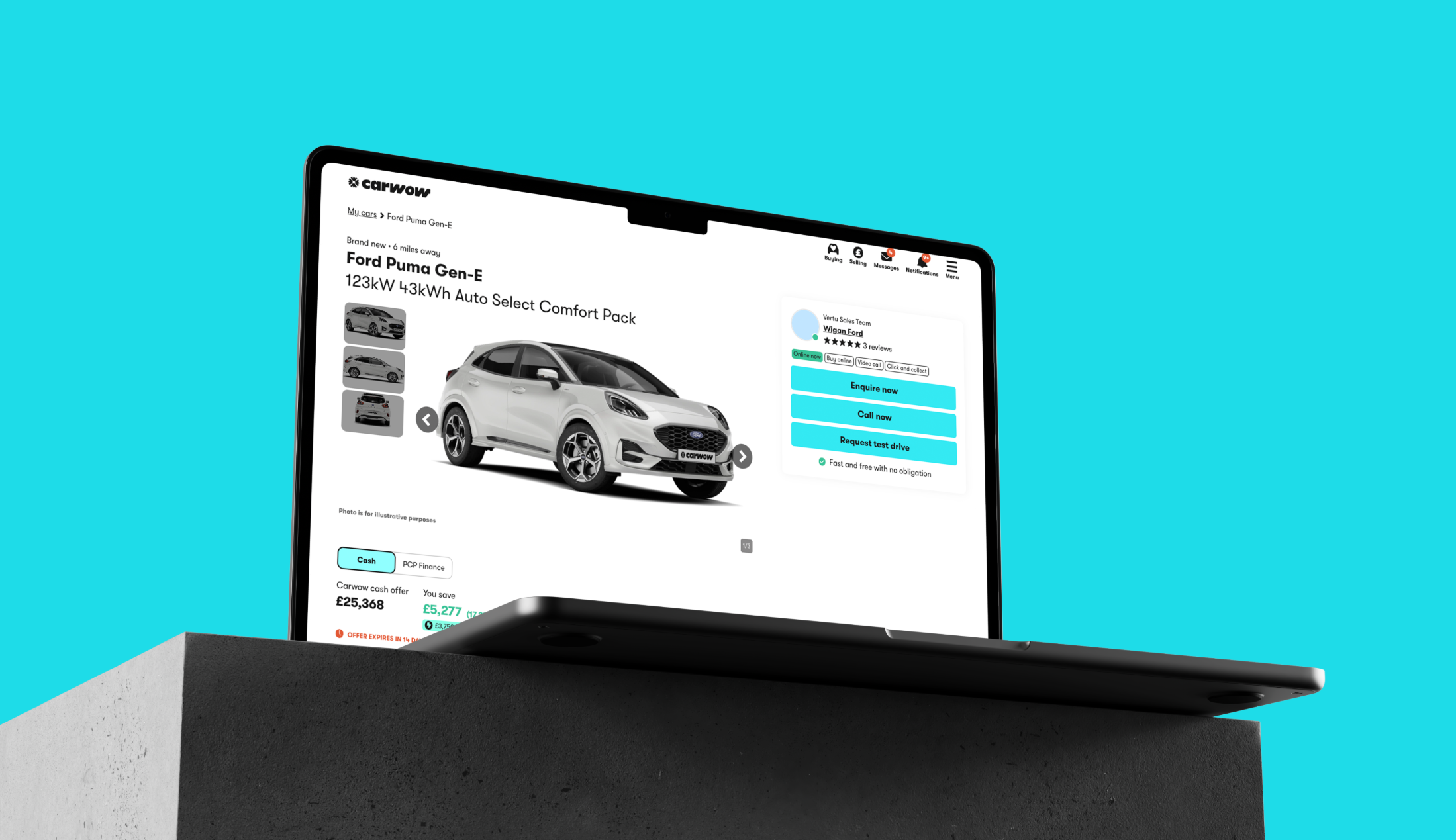

In a recent Carwow webinar, we explored our latest consumer research into EVs and what, if any, parallels we could take from the world of general tech adoption. Here are the key learnings from that session…

Just as consumer consideration for EVs appeared to be rising in 2023, the government announced the delay to the 2030 ICE ban, creating more uncertainty. Our flash survey immediately after the announcement, found that 41% were now less likely to buy an EV as their next car.

It’s not just government legislation that causes indecision; our customers tell us the range (42%), perceived lack of EV infrastructure (50%) and price mismatch with ICE vehicles (43%) are still major sticking points for them to make the leap. However on a more positive note, of the early adopters who already drive an EV, 81% said they intend to buy another in the future. So, if the products deliver this level of customer satisfaction, why is adoption lagging? Consistently negative press coverage doesn’t help the cause, spreading ‘FUD’ (fear, uncertainty and doubt). But, our research shows that 21% of buyers are what we refer to as ‘passive considerers’; those who expect to buy an EV in the future but not for their next car.

This represents a huge opportunity, and increases the onus on us all – OEMs, retailers and marketplaces like carwow – to help bridge the gap between EVs early adopters and the mass market.

Next wave of EV buyers need proof

Without getting too theoretical for a moment (!) there are social science models that look to explain how, why, and at what rate, new ideas and technology spread in society. I think those models can help give us in the automotive industry some historical context to what we’re seeing when it comes to EVs now, and where we might go from here.

If we look at a model called ‘Rogers Diffusion of Innovation’ we see that the adoption of EVs so far maps almost identically to this model. According to this framework, the EV market has successfully secured the commitment of ‘Innovators’ and ‘Early Adopters’ – around 16% of the market (in the model).

Now though, we need to actively engage with the next categories of adopters, the ‘Early Majority’ and ‘Late Majority’, who together comprise 68% of all potential customers. These two groups have different attitudinal and behavioural traits. The ‘Early Majority’ are logical, practical and driven by data when purchasing products, while the ‘Late Majority’ are also logical, but are also more cautious and risk-averse.

Building confidence and bridging the chasm

This next, more cautious group of customers is likely to wait for the technology to prove itself. Crucially, they’ll invest in what they perceive to be second-generation products they see as more reliable, having ironed out any of the kinks of first gen models. Providing comprehensive external validation - via in depth reviews and straight-talking comparisons - will be even more important to these groups - to get EVs into the hands of the next wave of buyers. According to the Rogers model, it’s at this point that we will begin the ‘Slope of Enlightenment’ which catalyses mass adoption. And we can lean into this in how we market EVs.

Bold claims about in-car technology won’t be enough to convert the ‘Early Majority’; they need to see, hear and experience EVs in real life to appreciate their advantages. For this group, the efficiency and substantial benefits of EVs are more important than the product’s perceived popularity. They’re pragmatists who ask around and seek external support to guide their decisions, so need a fuller sales experience via extended test drives and honest reviews.

Holistic experience

The rise of Chinese brands could also help accelerate EV adoption. In carwow Germany, BYD now claims the largest share of leasing enquiries and with the German market operating a year or two ahead of the UK, we might expect to see similar trends emerge here in the near future.

One of the most important ways OEMs and retailers can contribute to the mass adoption of EVs is by selling the whole experience, not just the car. Whether that be around talking to buyers about their lifestyle, home charging set-up, benefits of off-peak tariffs, putting them at ease over public infrastructure and talking to the general ownership experience.

Retailers are in a unique position to engage, guide and reassure, via digital channels and in person. They can also provide practical incentives to entice wavering customers, such as discounts on home charge points or favourable finance and warranty packages that mitigate risk and counter that embedded ‘FUD’.

With a more holistic view of EV ownership that addresses ‘Majority’ audience group concerns with practical, logical evidence, all consumer confidence will grow and sales will naturally follow.

I’d like to thank our external panellists Kim Costello - CMO & CCO - Pendragon, Natasha Kizzie - Automotive Industry Head - Google, Johan Bracht - Analyst - McKinsey, Abigayle Andre - Creator of She Talks Cars, for sharing their expert insights on our webinar; EVs: looking back to drive forward.

The webinar is now available for watching on demand.