What is Hire Purchase (HP) and how does it work?

October 26, 2021 by Ryan Hirons

Hire Purchase (often known as HP) is a common way to finance a car.

But what makes it different from other financing options, and why might it be the right – or a wrong – way for you to finance your next car? Read on for a full guide to HP finance.

What does Hire Purchase (HP) mean?

If you take the term Hire Purchase (commonly abbreviated as HP) somewhat literally, you’re essentially hiring a car from your finance company with the intent to purchase it.

You don’t own the car until the end of the agreement (it’s property of the finance company, similar to financing something like a TV) but once you make your final payment, the car is legally yours.

How does Hire Purchase work?

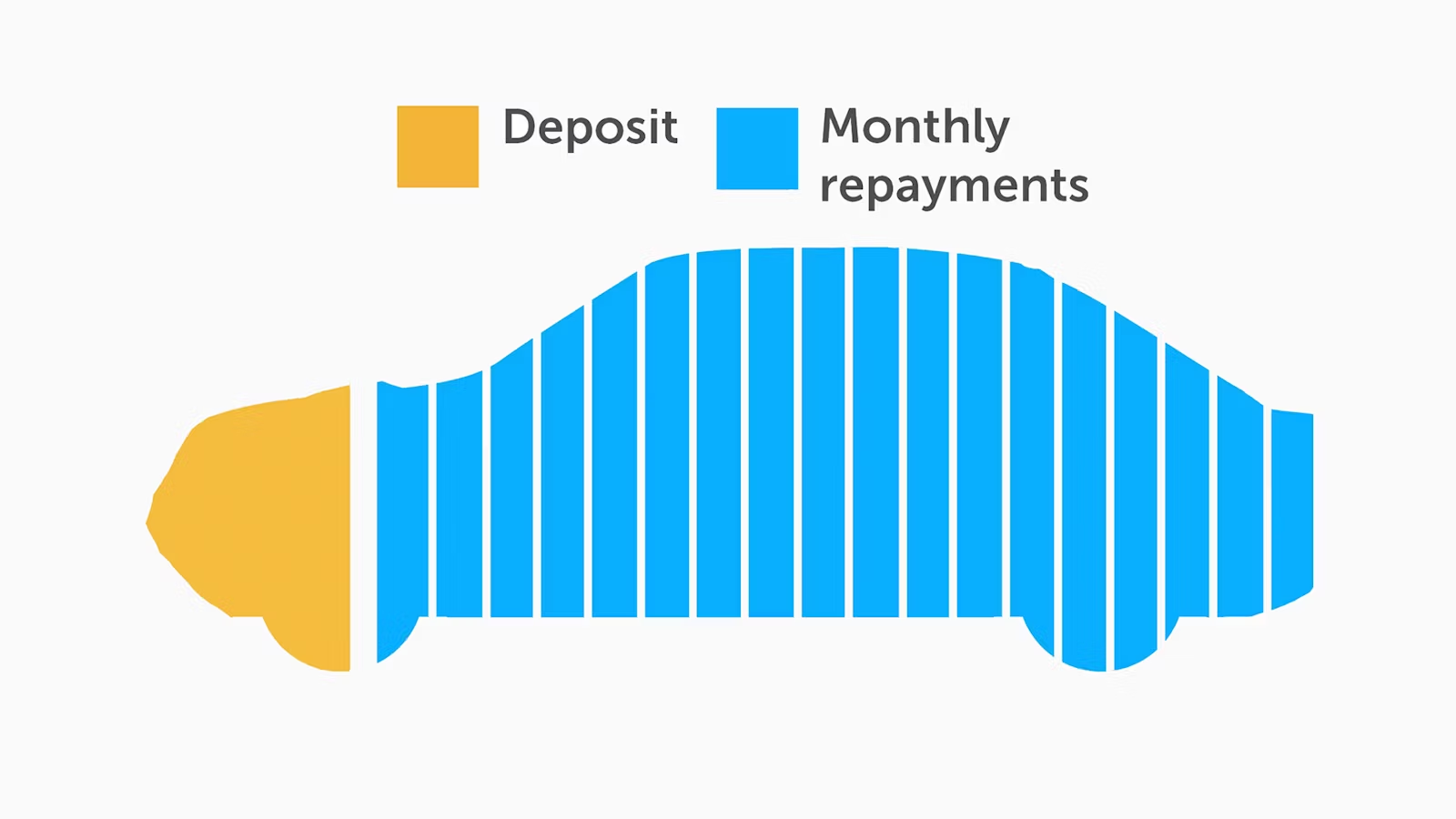

As far as finance agreements go, HP is a simple one to break down.

You’ll pay an initial deposit followed by a number of set monthly payments and a small final fee — often as little as £10.

Agreement lengths do vary, but you’ll usually find deals lasting anywhere from 12 to 48 months.

Once you’ve made your final payment, the car is legally yours so you can keep it or sell it on – the choice is yours.

Advantages of Hire Purchase

- You’ll own the car at the end of the agreement without any extra fees to pay

- You aren’t limited by mileage as with other finance types

- HP finance is often available on used cars as well as new models

Disadvantages of Hire Purchase

- The initial deposit and monthly payments are likely to be higher than a comparable PCP deal

- It may not be suitable if you don’t plan to keep the car at the end of your finance term

- The interest you’ll pay on the car may be higher than with a PCP deal

How do I find Hire Purchase deals?

You can buy a new car on an HP agreement through carwow, just head over to the deals page by tapping the green button below to find the latest offers.

HP agreements are often available on used cars too. If you’re unsure if a dealer is offering HP on the car you’re interested in, don’t be afraid to ask them.

Is Hire Purchase right for me?

You may want to consider an HP agreement if:

- You want to keep your car at the end of the finance agreement

- You don’t want to be bound by mileage restrictions

- You’d prefer to spread the full cost of a car evenly without a large final fee

- You’re looking to buy a used car on finance

What other finance options do I have?

If you don’t think HP is the right type of finance for you, there are other options, including paying with cash.

Personal Contract Purchase (PCP)

An alternative type of finance is Personal Contract Purchase (PCP). You can find a comprehensive guide by tapping the green button below, but in simple terms, you pay a deposit and a series of monthly payments, before being given the option to return the car when your finance term ends or paying a final ‘balloon payment’ if you want to own it outright.

Car leasing

Car leasing is another method. This is similar to renting a car – you’ll pay a monthly fee over a set period of time, though you don’t have the option to keep the car at the end of that agreement. Tap the green button below for more details on how that works.

Hire Purchase (HP) FAQs

How is Hire Purchase calculated?

A Hire Purchase finance agreement is calculated by subtracting the deposit amount from the total price to pay, with the rest spread over a number of monthly payments and a small final fee.

What deposit do I need to put down on Hire Purchase?

Typically, a Hire Purchase agreement sees you place at least 10% of the total price — though this will vary depending on your specific agreement.

Do I own my car with Hire Purchase?

Once you’ve completed your monthly payments and paid the small final fee, you’ll own the car outright.

Can I end my Hire Purchase agreement early?

You can pay to end your Hire Purchase agreement early if you so wish. Just inform your provider of your intent, and they’ll offer you a settlement fee — usually one lump sum calculated from any unpaid installments and interest.

If you wish to terminate your agreement and hand the car back, you can do so under voluntary termination.

The exact terms of this will be set in your agreement contract, but typically you’ll need to have paid off at least half of the total amount and you’ll have to hand the car back to the dealer.

When can I change my car on Hire Purchase?

Once you’ve paid off your Hire Purchase agreement, you’re free to do whatever you wish with the car.

Though you can’t transfer the agreement directly into a new model (as you can with many PCP agreements) the car is your legal property so you’re free to sell it and put the money towards another car.

Cars Change? Carwow!

Looking for a new set of wheels? With Carwow you can sell your car quickly and for a fair price – as well as find great offers on your next one. Whether you’re looking to buy a car brand new, are after something used or you want to explore car leasing options, Carwow is your one stop shop for new car deals.