PCP finance explained

October 04, 2022 by carwow staff

The vast majority of new cars are bought using PCP finance – our guide explains all

Around 90% of all the new cars bought privately in the UK each year are funded with some kind of financial product to spread the cost of the vehicle. And while car leasing and hire purchase agreements can suit some motorists, the vast, vast majority of buyers opt for a PCP, or personal contract purchase deal.

If you’re new to the car-buying game, or just want a bit of clarity while weighing up your purchasing options, this guide will cover the ins, outs, ups and downs of PCP finance.

How does PCP finance work?

Buying cars used to be a lot tougher, with customers needing to either fund them outright or take out a hire-purchase agreement that would pay off the entire car in monthly instalments over a course of years.

Enter PCP finance, which was pioneered by Ford and emerged on the scene in the 1990s, when it was marketed as ‘Options’. Other manufacturers soon followed suit, and the PCP norm was born.

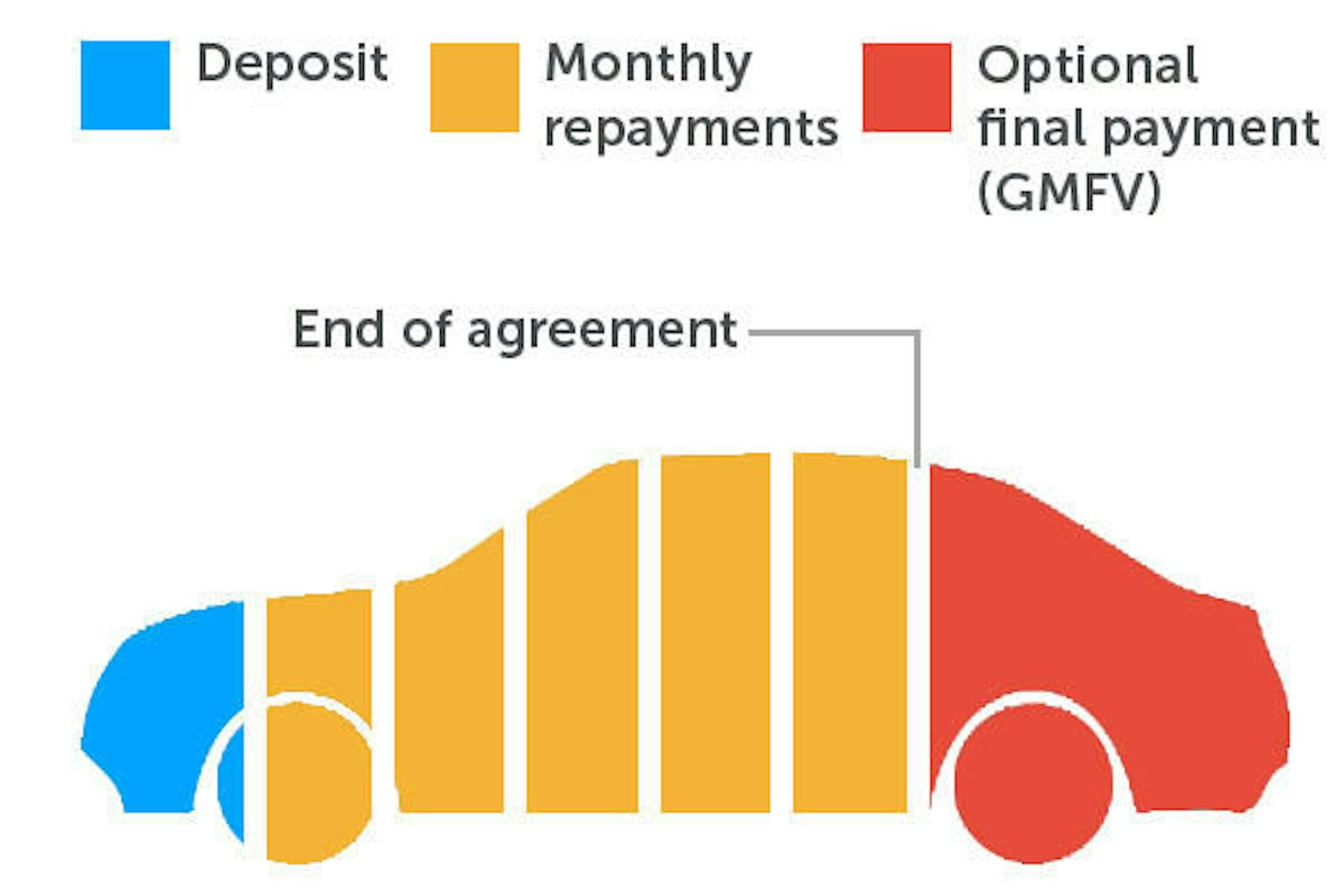

PCP deals typically last for three or four years, and comprise three sections:

- The deposit

- Monthly repayments

- Final, optional ‘balloon’ payment.

The first two sections – the deposit and the monthly repayments – do not pay off the car itself, instead paying off its depreciation.

The amount a car is expected to depreciate over the course of a PCP contract is set at the start of the contract, and is calculated/predicted based on a car’s likely value at the end of the deal.

That predicted value is known as the guaranteed minimum future value, of GMFV.

The GMFV is then becomes the final, optional balloon payment, and when faced with this at the end of the (let’s say) four-year PCP deal, you have three options.

- Pay the balloon, and own the car outright.

- Don’t pay the balloon, and the car reverts back to the dealer and/or the manufacturer’s finance company.

- Use accrued ‘equity’ to go towards a new car; this one is complicated, so we’ll go into more detail below.

The third option

This is the option most people take, and it’s a very neat one.

Because the GMFV is based on a predicted depreciation curve, you may find the monthly repayments you have been making over the course of the PCP deal add up to a greater amount than the car has actually depreciated.

If this is the case, you have technically overpaid the depreciation, although this scenario is sometimes referred to having accrued equity in the car. If this happens, you can use this ‘equity’ to go towards a new car, as long as you buy a car from the same manufacturer – EG another Ford, another Audi, etc.

Let’s model this out.

How much do I pay on PCP finance?

A car costs £30,000. It is predicted to be worth £10,000 in three years’ time (this is its GMFV), meaning between the deposit and monthly repayments, you need to fund £20,000 over the course of the contract.

You have managed to find (for the purposes of simple maths) a 0% interest deal and put a £5,000 deposit down, leaving you to pay off £15,000 over three years. That’s 36 monthly repayments of £416.67.

So you get to the end of the three years and have paid a total of £20,000. If the car’s GMFV was set perfectly it will have depreciated by £20,000,

But finance firms prefer to be conservative and cautious with a car’s predicted future value, rather than be overly optimistic.

So let’s say the car is actually worth £12,000 – it’s depreciated only by £18,000, yet you have paid off £20,000.

The dealer, at this stage, can take that £2,000 extra you’ve paid for depreciation that didn’t happen and switch if over to go towards the deposit on a new car, as long as you stick within the same brand.

If you choose to go for a different brand, decide to buy a second-hand car or pick another avenue (such as not getting a replacement car at all), you don’t get to walk away with that £2,000. Though you could pay £10,000 and get a car that is actually worth £12,000.

What are the benefits of PCP finance?

PCP deals offer great flexibility, giving you three options at the end of the deal.

They also tend to bring more affordable monthly repayments as, unlike a hire purchase agreement, you’re paying off the car’s depreciation, rather than the car itself.

PCP deals are also offered by every new-car dealer, from firms that sell superminis by the dozen, to high-end prestige dealers.

They also offer certainty with regard to what the monthly repayments are, and what the car will be worth at the end of the deal.

PCP deals also often bring with them discounts not available to people buying cars outright.

These may take the form of a 0% interest rate, which essentially amounts to a free loan. You might need to choose a specific engine or trim level to take qualify for a 0% interest PCP offer, but such deals can nonetheless be very attractive.

Dealers may also offer deposit contributions with PCP deals, with these effectively reducing the list price of the car, resulting in lower monthly repayments.

What are the potential risks involved with PCP finance?

As with any financial contract, you need to go into a PCP deal with your eyes open. First, know that while you will be the car’s registered keeper, the finance company will own the vehicle unless you pay the balloon fee at the end of the deal.

Also be aware that if you fail to keep up monthly repayments, the car can be repossessed, with this negatively impacting your credit rating.

PCP deals also tend to bring with them mileage limits. You can set this at the start of the deal, but higher mileage limits bring increased monthly repayments, as higher-mileage cars are worth less, therefore a 60,000-mile car would have a lower GMFV than a 30,000-mile one, meaning you would have more depreciation to pay off. Go over the mileage limit and you will face excess fees, which are calculated on a per-mile basis, and can add up.

PCP deals also have condition clauses, so while normal wear and tear will be acceptable, if the car is damaged you will likely face fees for this as well.

Who offers PCP finance deals?

Almost every car dealer. Large brands often have their own finance houses, organising PCP deals themselves, while smaller dealers (including independent retailers) may offer finance via a third-party company.

You can also buy second-hand cars using PCP finance, though interest rates for used PCP deals tend to be higher, partly as predicting GMFVs is trickier, and partly as the car may well be outside of its original warranty, meaning a significant repairs or issues bring greater risks.

Is PCP finance for you?

PCP finance makes new cars attainable, despite their relatively high list prices. If you are comfortable making monthly repayments over a period of years, and don’t mind not being the legal owner of the car, they can be a great option, especially if you think you will be handing the car back at the end of the deal. If you know you will want to own the car outright, though, a hire purchase arrangement may be a better fit.

Do note you will have to maintain the car in-line with what’s specified in the PCP contract. It will likely be stipulated that this must be done at a main dealer, as this helps maintain residual values.

Alternative car financing options

There have never been so many routes into a new or used car, with the main alternatives to PCP finance being:

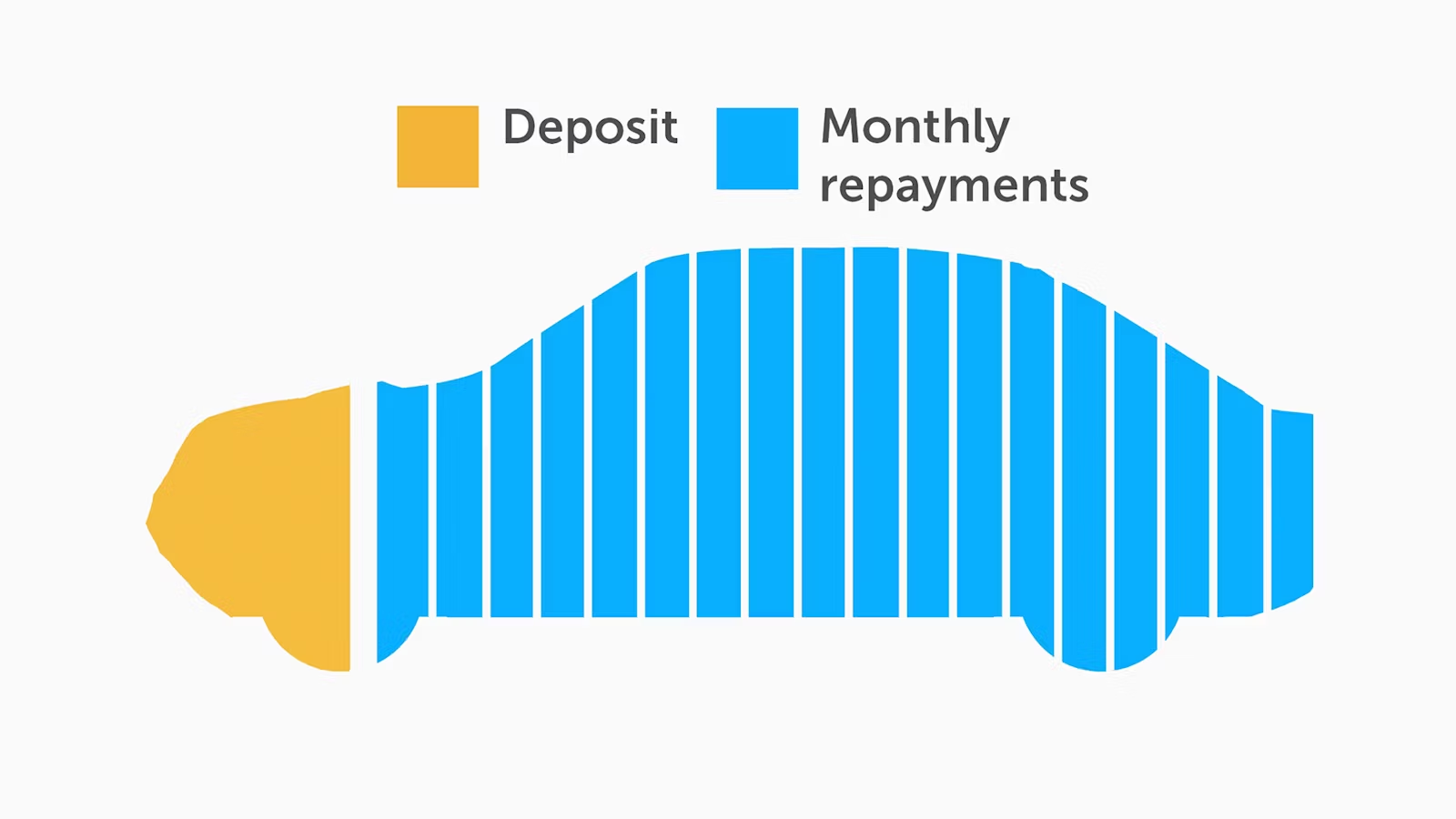

Hire purchase

A hire purchase deal sees you put down a deposit, with this and the monthly repayments paying off the car in its entirety. HP deals tend to bring higher monthly repayments than PCP offers, but they also see you own the car at the end of the deal, with no balloon payment.

Leasing/personal contract hire

A lease deal, also known as personal contract hire, sees you rent a car for a period of time, typically two years. Leasing deals can bring more affordable monthly repayments than PCP finance, though you will get no option to buy the car at the end of the deal, and if the car depreciates less than predicted there is no way of making use of any potential overpayments , as there is with PCP.

Car subscription

The car subscription model is a relatively new one, but sees you pay a monthly fee for the car, with insurance, tax and servicing also covered by this payment – petrol/diesel/electricity will be your only additional costs. Not many manufacturers offer subscription services, but while they bring relatively high monthly repayments, they also offer a good deal of flexibility, allowing you to change cars every few months.

PCP FAQs

What credit score do I need for PCP finance?

There is no specific credit score required for PCP deals, with finance companies making their own assessments based on your history. PCP finance may be available even if you have a poor credit score, though you may need a specialist firm offering this, and interest rates can be high.

What happens at the end of a PCP contract?

You have three options: 1. Walk away owing and owning nothing, 2. Pay the GMFV and own the car outright, 3. Use any overpayments to go towards a new car if you stick within the same brand.

Can I end my PCP contract early?

Yes, but you will need to have paid off at least 50% of the agreed finance amount; this includes interest, as well as the balloon/GMFV payment. If you haven’t paid off 50%, you will need to make up any shortfall before ending the contract.

Can I sell a car on PCP?

No, as you do not own the car – it remains the property of the finance company unless you have completed the deal and made the balloon payment. A dealer may be able to help you end the finance agreement early and get into a new car, but by definition you cannot sell a car that is ‘on’ PCP.

Can I modify a car on PCP?

No. PCP contracts will have specific clauses about maintaining the car, and will also preclude modifications. You may can make reversible changes like installing a phone mount, but if in any doubt contact the finance company to check.

Who pays for repairs on a PCP car?

It depends what sort of repairs are needed. If the car develops a fault and the car is within manufacturer warranty, repairs may well be covered by this. If the car is involved in a collision, your insurance company should fund repairs, though liaise with the finance company before these are made.

If the car sustains a parking ding, for example, be wary about organising repairs yourself: the finance firm may be able to tell (perhaps with a paint depth gauge) if the car is handed back at the end of the deal, charging you for conducting an “unauthorised repair”. All of this should be specified in your PCP contract, but the finance firm will most likely need to be told of any damage and organise repairs themselves, as poor repairs can reduce a car’s value.

Will PCP finance affect my mortgage application?

Potentially, yes. Mortgage lenders need to know what your regular outgoings are, and PCP repayments constitute these.

Change cars online with carwow

Looking for an easy way to change your car? Then carwow is the place to go. You can sell your car online for a great price, and get the best deals on a new one. All through our network of trusted dealers and all from the comfort of your home. Tap the button below to get started today.